Zim remittances surge as women remitters lead the pack

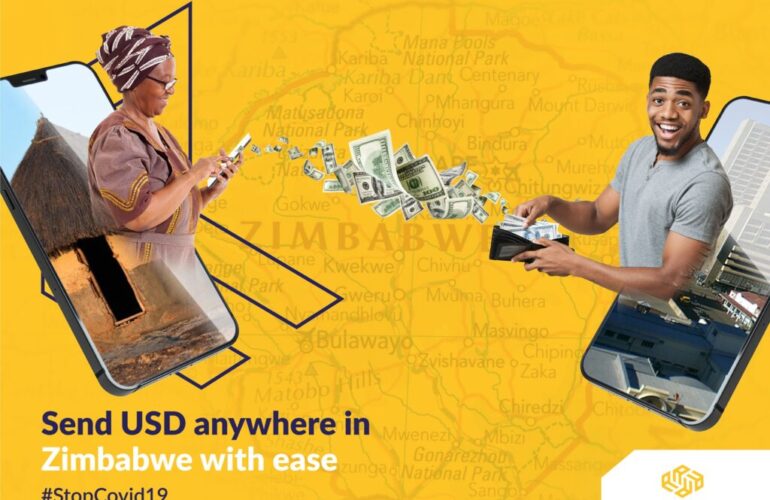

ACCESS FOREX

As formal remittances into Zimbabwe surged 58 percent in 2020 to a record $1 billion, data from a local think tank has unveiled that women remitters are leading the pack.

According to a United Nations Women (UN Women) survey, analyzing the relationship between gender and remittances, migrant women workers have been leading the pack in sending money back home to loved ones.

The research showed that while women tended to rely more on in-person cash transfer services in the past, the tide had turned with migrant workers now preferring formal channels for security.

“The research found that, while women typically earn less than men and pay more in transfer fees, the average remittance amounts they send are the same as or even greater than those of men, implying that they tend to remit a larger portion of their earnings than do men,” the UN Women paper said.

In Zimbabwe’s case, the survey also highlighted that the emergence of new players in the remittance play like Access Forex, Senditoo, and the traditional ones like World Remit and Mukuru had made it easier for women remitters to send money back home.

Access Forex’s spokesperson Shingai Koti said the increase in trust by women was not alarming as the remittances firm, which services the United Kingdom and South Africa corridors, and others had put in place measures to stimulate remittances from the previously marginalized.

“On our books, women make up 50 percent of the remitters and this is a huge step especially as we commemorate International Women’s Day.

“It shows that emancipation and financial inclusion is finally reaching the previously marginalized and as a business, we continue to promote this through our wide distribution network around Zimbabwe also allowing women to send money locally,” Koti said.

Koti said the trend was anticipated to surge further in the future on the back of sectorial liberalisation efforts by the central bank and the company’s efforts to promote financial inclusion.

“In South Africa alone, 52 percent of our books is made up of women. This is a pattern we intend to maintain in the future as we grow as a business. We want to ensure that all our customers find a secure way to send money back home,” the Access Forex spokesperson said.

Meanwhile, Zimbabwe’s diaspora remittances increased by 58 percent to US$1 billion last year surpassing US$635,7 million realised in 2019.

In 2020, the Reserve Bank of Zimbabwe had projected that diaspora remittances would close the year at US$940 million.

In his 2021 Monetary Policy Statement last month, RBZ Governor Dr John Mangudya attributed the improvement in Diaspora remittances to the liberalisation of the use of free funds in the country and improved channelling of remittances through formal channels.

https://www.facebook.com/AccessForexIntl

https://www.linkedin.com/company/accessforex