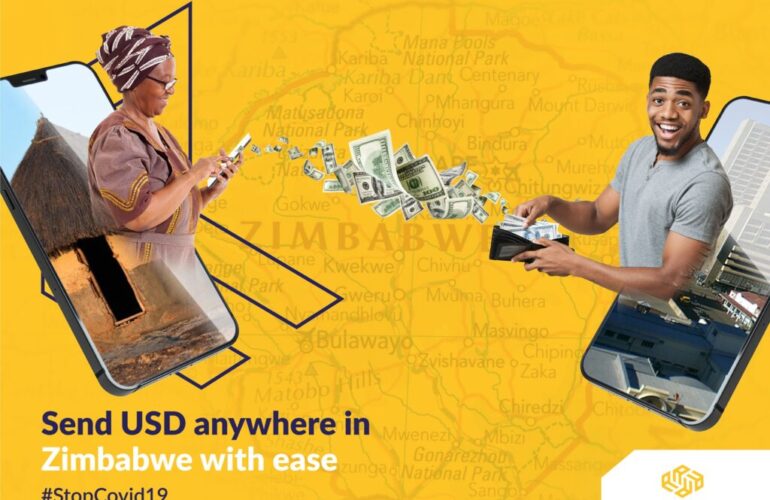

Introducing paperless remitting for South Africa

30.11.2021. The launch of a new USSD based remittance service for clients in South Africa by Access Forex could not be better timed.

Christmas time is when many Zimbabweans living in South Africa go home to spend time with their loved ones, usually returning to South Africa just after New Years to resume work and fend for their families. Following the detection of the Omicron variant, Ndumiso Chuma, like many other Zimbabweans is weighing up his options; “I work as a gardener in Wynberg, and my biggest fear is that if they decide to do a lockdown, I won’t be able to go back to Cape town and then what happens to my son’s school fees needed in January? I can’t risk it, better to stay.”

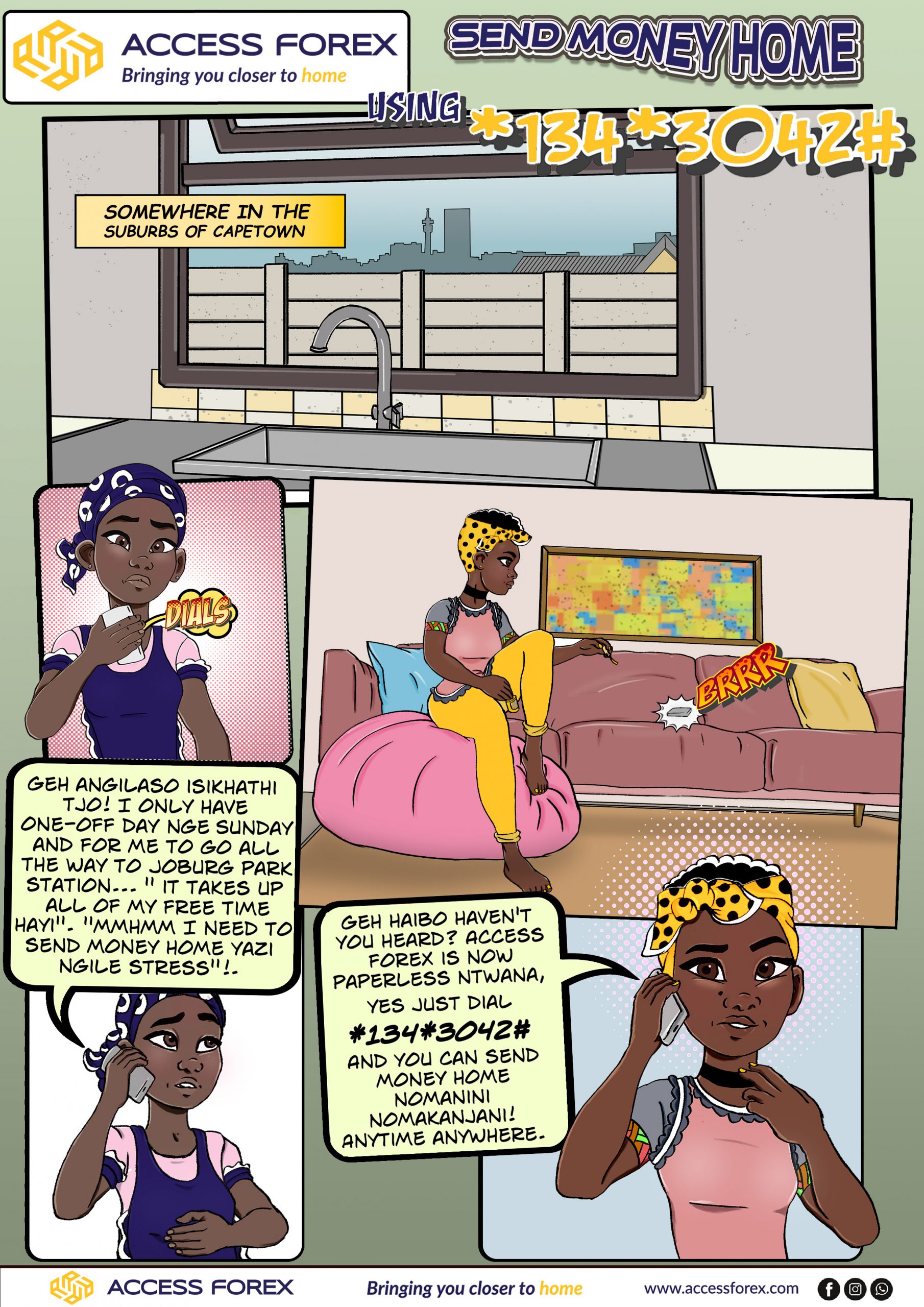

Using *134*3042#, it is now possible to send money to Zimbabwe from a cellphone. All you need is a South African line and network. The USSD uses zero data.

You can register, select beneficiaries, and initiate the transaction all without leaving your home or place of work. For those without bank accounts yet, the USSD allows them to complete the transaction by paying in the cash amount at any PEP, Shoprite, Game, USave, House & Home, Ackermans, Checkers, PicknPay, SPAR, Boxers or Makro. It makes remittance completely paperless and works with any type of handset. Effectively this means that you avoid queues and paperwork normally associated with cash pay-ins. The system will generate a code known as an SCode, and you simply proceed with this to any of the partner stores, submit the SCode to a teller there, together with the cash amount and your receiver gets their money in Zimbabwe, instantly.

To this end, the new channel of distribution will be launched today in a bid to make remittance products and services available and affordable to a larger number of Zimbabweans living anywhere in South Africa.

The head of sales & marketing for Access Forex, Shingai J. Koti, explained that the technological addition from the company is geared towards enhancing customers’ experience and ease of remittance transactions under the stable of Access Forex. She further added that the company will constantly look for ways in delighting its customers both in the diaspora and at home.

#omicron #PEP #Shoprite #Game, #USave, #House & Home, #Ackermans, #Checkers, #Pick nPay, #SPAR, #Boxers or #Makro #christmas #zimbabwe #diaspora #remittances

For more information call the Access Forex Call Centre +27678352591